Biosimilars Market Research, 2031

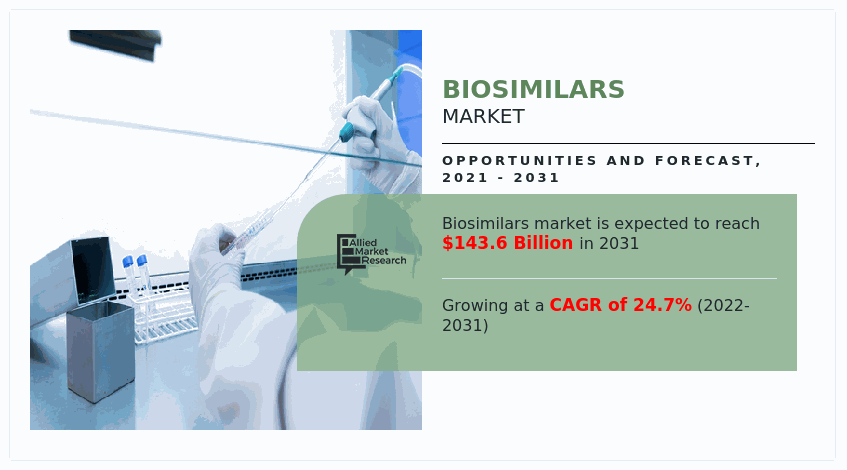

The global biosimilars market size was valued at $15.9 billion in 2021, and is projected to reach $143.6 billion by 2031, growing at a CAGR of 24.7% from 2022 to 2031. Increase in prevalence of different types of cancers such as lung cancer, blood cancer, and brain tumor are the major factors of biosimilars market growth. For instance, as per the Globocan 2020, lung cancer is the second ranked cancer, in terms of patient count in Europe with estimated 477,534 newly diagnosed patients.

Biosimilars have major role in treatment of cancer as supportive treatment for chemotherapy. For instance, Novartis, a leading pharmaceutical company, offers a biosimilar Ziextenzo (Pegfilgrastim-bmez Injection), used to reduce the chance of infection in people who have certain types of cancers and receive chemotherapy medications that may decrease number of neutrophils. Hence,Increase in prevalence of various cancers boost growth of the global biosimilars market size.

Biosimilar drugs, are biotherapeutic products similar in terms of quality, safety, and efficacy to an already licensed reference biotherapeutic product. Biologics are used for treatment of chronic diseases such as cancer and autoimmune diseases. Development of biologics is a costly and timeconsuming process while biosimilar development saves time and resources by avoiding unnecessary duplication of clinical trials.

Key Market Dynamics

Increase in prevalence of autoimmune diseases such as ankylosing spondylitis, and rheumatoid arthritis drives growth of the Biosimilars Market Size. For instance, according to a paperpublished in “Scandinavian Journal of Rheumatology”, in 2020, titled ‘Prevalence of ankylosing spondylitis in Spain’, about 7.3% population showed positive screening for ankylosing spondylitis. Biosimilars, such as infliximab-axxq (Avsola), infliximab-qbtx (Ixifi), infliximab-dyyb (Inflectra), and infliximab-abda (Renflexis) are used for treatment of chronic pain in arthritis. Furthermore, increase in number of orthopedic hospitals and diagnostic centers boost diagnosis and treatment rate of diseases. For instance, according to Definitive Healthcare data in 2020, there were more than 30,500 orthopedic surgeons practicing in the U.S. Thus, increase in prevalence of painful autoimmune diseases and rise in number of hospitals contribute toward Biosimilars Market Growth.

Increase in incidences of diabetes boosts growth of the insulin biosimilars market. For instance, according to the International Diabetes Federation (IDF), in 2020, approximately 537 million adults (20-79 years) were living with diabetes and this number is expected to rise from 643 million in 2030 to 783 million in 2045. The biosimilar of insulin analogues serves as cost-effective option for diabetes patients. For instance, Biocon biologics, a leading biosimilar company, received U.S. food and drug administration (FDA) approval for first interchangeable biosimilar Semglee (insulin glargine-yfgn) injection for treatment of diabetes. Thus, rise in prevalence of diabetes and latest product approvals drive growth of the Biosimilars Market Size.

Biosimilars Market Opportunity created by increase in product approvals and emerging interest in biosimilars by key players . For instance, in December 2021, Coherus BioSciences, a leading biosimilar developer, received U.S. food and drug administration (FDA) approval for adalimumab biosimilar and Yusimry (CHS-1420) for the treatment of tumor. Thus ,increase in product approvals by respective authorities boosts growth of the Biosimilars Industry.

Moreover, favorable government policies and new product launches in the global Biosimilars Industry along with regulatory approvals are expected to contribute toward growth of themarket. For instance, in 2021, the U.S. President Joe Biden signed Advancing Education on Biosimilars Act of 2021, which authorizes the food and drug administration (FDA) to educate patients and healthcare providers about benefits of biosimilars. This follows reintroduction of Bolstering Innovative Option to Save Immediately on Medicines Act (BIOSIM Act), which increases reimbursement of biosimilar drugs. However, complex manufacturing and higher cost of biosimilar development hamper growth of the market.

Market Segmentation

The biosimilars market is segmented on the basis of type, application, and region. By type, the market is categorized into human growth hormone, erythropoietin, monoclonal antibodies, insulin, granulocyte-colony stimulating factor, and others. Depending on application, it is divided into blood disorders, oncology diseases, chronic & autoimmune diseases, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Arabia, South Africa, and LAMEA).

By Type

Monoclonal antibodies segment holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Depending on type, the monoclonal antibodies segment is expected to dominate the Biosimilars Market Share in 2021, and is expected to continue during the Biosimilars Market Forecast period, owing to increase in R&D activities to develop new biosimilars and rise in use of monoclonal antibodies for cancer treatment. However, the insulin segment is expected to witness considerable growth during the forecast period, owingto increase in prevalence of diabetes.

By Application

Oncology diseases segment holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

By application, the oncology diseases segment dominated the market in 2021, and this trend is expected to continue during the forecast period, owing to increase in prevalence of cancer. However, the chronic & autoimmune diseases segment is expected to witness considerable growth during the forecast period, owing to rise in product approvals and increase in demand for advanced treatment.

By Region

Europe region holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Depending on the region, Europe garnered a major share in the biosimilars market in 2021, and is expected to dominate the global market during the forecast period, owing to rise in prevalence of cancer, favorable government initiatives, and well-established healthcare infrastructure in the region. However, Asia-Pacific is expected to register significant growth, owing to increase in number of hospitals, prevalence of cancer, and high population.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biosimilars market analysis from 2021 to 2031 to identify the prevailing biosimilars market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biosimilars market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biosimilars market trends, key players, market segments, application areas, and market growth strategies.

Biosimilars Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Merck & Co. Inc., Kashiv Bio Sciences, Eli Lilly and Company, Pfizer Inc., Dr. Reddy’s Laboratories, reliance life sciences, Intas Pharmaceutical Ltd, Amgen Inc., Biocon Ltd, Teva Pharmaceutical Industries Limited |

Analyst Review

This section provides opinions of top level CXOs in the biosimilars market. According to CXOs, biosimilars or biosimilar drugs have structural and therapeutic similarities with reference biologics. Biosimilars are available at lower prices as compared to biologics.

the biosimilar market is segmented on the basis of type, application, and region. By type, it includes human growth hormone, erythropoietin, monoclonal antibodies, insulin, interferon, and granulocyte-colony stimulating factor. Biosimilars are used for treatment of various diseases such as cancer, diabetes, and autoimmune diseases.

Factors such as increase in chronic diseasessuch as rise in biosimilar product approvals and development of various biosimilar drugs propel growth of the biosimilars market. In addition, increase in geriatric population and surge in demand for economical treatment of various diseases are expected to contribute toward growth of the biosimilars market.

Europe is expected to witness highest growth in terms of revenue, owing to rise in incidences of cancer, high number of biosimilars approved in the region, presence of key players for manufacturing & developing biosimilar drugs, and increase innumber of hospitals in the region.However, complexity of biosimilar development is expected to hamper the market growth

The total market value of biosimilars market is $15,919.32 million in 2021.

The forecast period in the report is from 2022 to 2031.

Europe is the largest regional market for Biosimilars.

The top companies that hold the market share in biosimilars market are Amgen Inc., Biocon Ltd., Dr. Reddy’s Laboratories, Eli Lilly and Company, Intas Pharmaceutical Ltd., Kashiv Bio Sciences, Merck KGAA, Pfizer Inc., Reliance Life Sciences Private limited, and Teva Pharmaceutical Industries Ltd.

The market value of biosimilars market in 2022 was $19660.36 million.

Yes, biosimilars companies are profiled in the report

The key trends in the biosimilars market are increase in demand for cost effective treatment, rise in prevalence of cancer and new product approvals in the market.

The base year for the report is 2021.

Loading Table Of Content...